2026 Luxury Industrial Condo Market Projection for Houston, TX

In Houston’s most affluent corridors, a new category of commercial real estate is gaining traction: the luxury industrial condo. For buyers searching for a luxury industrial condo in Houston, TX, demand is increasingly focused on high-design, secure, flex-industrial ownership spaces that combine utility with prestige.

Projects like XSpace Houston exemplify this shift, offering individually deeded industrial condo units with high-clearance ceilings, premium finishes, and lifestyle-driven campus design tailored to entrepreneurs, collectors, and owner-users.

Unlike traditional warehouse space for lease, a Houston luxury industrial condo for sale provides long-term ownership, asset control, and protection against rising lease rates. Within the Memorial, Tanglewood, and Uptown trade area, including ZIP code 77024, the supply of individually owned flex-industrial space remains structurally limited. While large-scale industrial development exists across Greater Houston, infill product near high-net-worth residential neighborhoods is scarce, making branded, design-forward campuses especially competitive.

For buyers evaluating the 2026 outlook for luxury industrial condos in Houston, this asset class sits at the intersection of real estate ownership, business infrastructure, and lifestyle storage. Whether used for car collections, e-commerce operations, medical services, specialty trades, or family office operations, these industrial condo units serve as both operating space and long-term capital-preservation vehicles.

Over the next 24 months, the Houston luxury industrial condo market is positioned for continued appreciation, supported by limited infill supply, strong owner-user demand, and rising replacement costs. The following report outlines pricing projections, demand drivers, supply constraints, and strategic considerations for buyers, investors, and developers evaluating this emerging niche.

XSpace Houston

2026 Luxury Industrial Condo Market Projection

Houston, TX 77024 | 24-Month Outlook

Executive Summary

Luxury industrial condominiums—typified by brands such as XSpace (high-clearance, flex-industrial ownership units with premium finishes and lifestyle-oriented design)—represent a niche but rapidly maturing asset class in Houston. Within and immediately adjacent to ZIP 77024 (Memorial / Tanglewood / Uptown trade area), demand is driven less by traditional logistics users and more by high-net-worth individuals, entrepreneurs, collectors, and small operating businesses seeking ownership, security, and prestige.

24-month outlook (base case): - Pricing: +8% to +18% cumulative appreciation (central estimate ≈ +12%) - Demand: Strong and supply-constrained - Liquidity: Moderate but improving as buyer awareness increases - Risk profile: Lower volatility than office/retail; higher than traditional industrial.

The asset class is expected to outperform conventional condos and keep pace with well-located light industrial, supported by limited supply, ownership psychology, and inflation-hedging characteristics.

Market Definition & Product Profile

Luxury industrial condos in the Houston context typically feature: - Individually deeded industrial/flex units - 18–28+ ft clear heights - Grade-level and/or semi-dock loading - Climate control capability - High-end façade, controlled access, and strong HOA governance - Target users: collectors (cars, boats, art), contractors, medical/lab users, e-commerce operators, family offices

While 77024 itself has limited industrial zoning, the effective market includes adjacent infill submarkets (Spring Branch, Northwest Houston, Near North Loop) that directly serve Memorial-area buyers.

Demand Drivers (Why This Segment Works)

1. Ownership Scarcity in Infill Houston

Houston has abundant industrial land overall, but very little new infill industrial product available for individual ownership near affluent residential areas. Luxury industrial condos solve this gap.

2. High-Net-Worth Buyer Profile

Buyers are typically: - Cash or low-leverage purchasers - Insensitive to cap rates - Motivated by utility, privacy, and asset control This insulates pricing from traditional industrial leasing cycles.

3. Small-Business & Entrepreneur Growth

Medical services, trades, specialty manufacturing, and online commerce continue to favor flexible, owner-occupied space over leasing, particularly when lease rates rise.

4. Inflation & Replacement Cost Support

Rising construction costs (steel, concrete, labor) provide a price floor, as replacement cost for comparable product continues to move upward.

Supply Analysis

New supply: Very limited within 5–7 miles of 77024

Entitled land: Scarce and increasingly expensive

Development risk: High (zoning, neighborhood resistance, capital costs)

Result: structural undersupply, particularly for projects with strong design and branding (e.g., XSpace-style campuses).

24-Month Price & Performance Forecast

Price Appreciation (Per-Square-Foot Basis)

Scenario | 24-Month | Projection Drivers

Conservative | +5% to +8% | Slower economy, higher rates

Base Case | +8% to +18% | Demand > supply, infill scarcity

Upside | +20% to +25% | Rate cuts + accelerated HNW adoption

Transaction Velocity

Units under ~1,000 SF: fastest absorption

Larger units (>5,000 SF): slower but higher absolute dollar appreciation

Rental & Investment Considerations

While many buyers are owner-users, rental demand is increasing.

Typical characteristics: - Gross yields: modest (3–5%) - Net yields: compressed by HOA fees - True return driver: appreciation + optionality

This is best viewed as a hybrid real-asset / operating asset, not a pure income play.

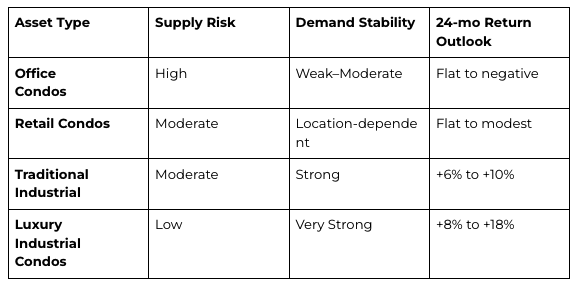

Competitive Position vs Other Asset Classes

Key Risks to Monitor

Over-replication of concept without differentiation

HOA mismanagement impacting resale

Zoning or neighborhood pushback on new projects

Economic shock reducing discretionary HNW purchases

Despite these, downside risk is mitigated by scarcity and owner utility value.

Strategic Recommendations

For Buyers (77024-based users): - Acquire early in project lifecycle - Favor flexible layouts and higher clear heights - Prioritize security, access, and HOA quality

For Investors: - Target smaller, more liquid units - Focus on branded developments - Underwrite appreciation, not yield

For Developers: - Infill sites within 15 minutes of Memorial are optimal - Design and branding matter as much as functionality - Pre-sales to local HNW networks reduce risk

Conclusion

Over the next 24 months, luxury industrial condos serving the 77024 trade area are positioned to be one of Houston’s strongest niche real estate performers. Structural undersupply, affluent demand, and rising replacement costs support above-average appreciation with controlled downside risk.

This segment should be viewed as a long-term strategic asset class, particularly for owner-users and capital preservation investors.